espp tax calculator uk

The ESPP gives you the chance to own a. The share price of our company is recorded on March 1st and August the 31st we get to buy the shares at the minimum of the two with an additional 15 discount.

Adjust Cost Basis For Espp Rsu Tax Return Wealth Capitalist

Tax advantages on employee share schemes including Share Incentive Plans Save As You Earn Company Share Option Plans and Enterprise Management Incentives.

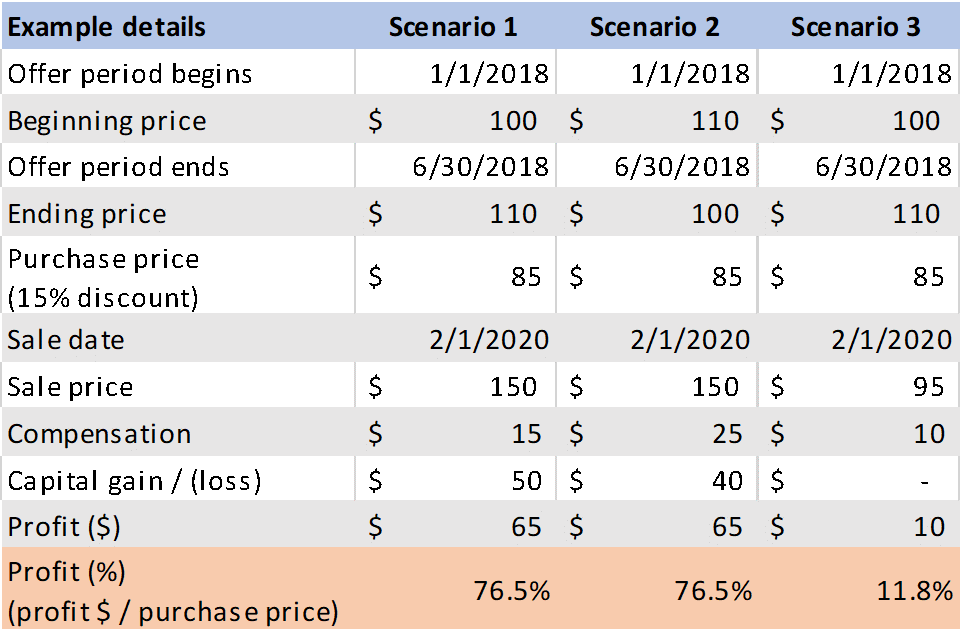

. You have an automatic 4 profit which is automatically taxed as a benefit at your marginal tax. Market Price on the. The gain calculated using the actual purchase price and.

Stamp Duty Reserve Tax SDRT when you. An ESPP is a way for you to purchase shares in your company through payroll deductions sometimes at a discounted price. You can deduct certain costs of buying or selling your shares from your gain.

If you do a same-day sale youll pay ordinary income tax on the gains between your discount price and the current stock price at whatever your. The ESPP tax rules require you to pay ordinary income tax on the lesser of. Most people have trouble calculating adjusted cost basis for filing taxes.

Fees for example stockbrokers fees. Your work makes Intuit successful and the Employee Stock Purchase Plan ESPP is another way to be rewarded. This accumulates over a certain period and at the end of that the money is used to purchase shares.

You choose a percentage that will be withheld from your payslip each month say 5. So therefore lets say I put 500 a month in to the share save scheme after tax and NI is deducted at the 12 month plan end I have 6000. Navigating the performance and tax implications of your employee stock purchase plan can be overwhelming.

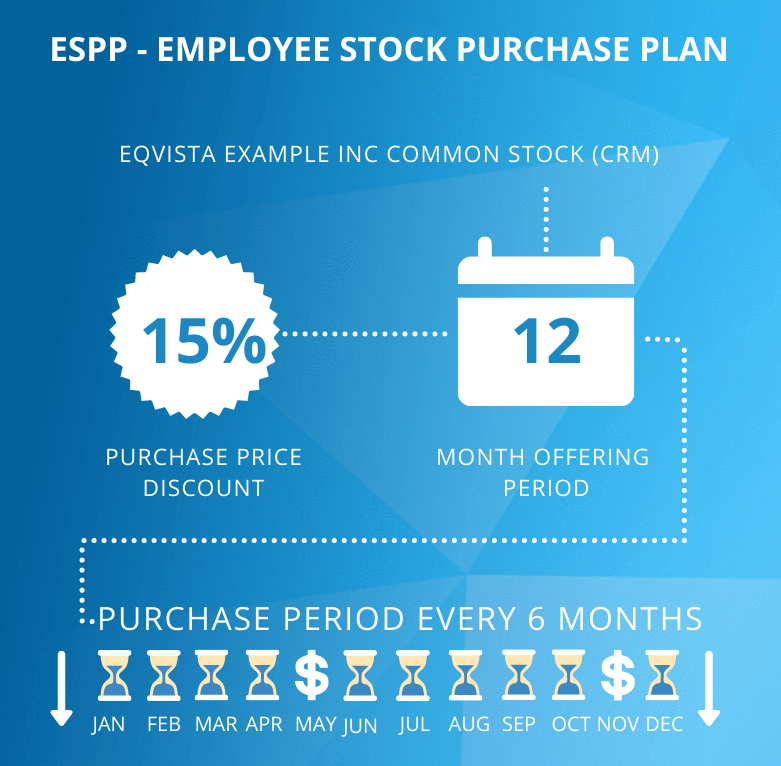

Under a nonqualified ESPP when the shares are. The discount allowed is normally 15 of the. Employee Stock Purchase Plan ESPP Calculator It is an online tool for tax calculation and used to determine your net gain after tax value on your ESPP based on grant date exercise date.

Tax rules for ESPPs are weird. The FMV of the shares are 30 I pay. If your employer has a 20 discount for you you pay 16 for the ABC stock.

If the purchase price is less than 100 of the fair market value of the shares on the purchase date then the discount is taxed as ordinary income. I will be contributing 150. Employee Share Scheme UK Guide 2022 In the US theres a tax-advantaged employee stock purchase plan ESPP under which employees can purchase stock in their.

An ESPP employee stock purchase plan is an employee ownership plan that allows participants to purchase stock in their company at a discount often between 5-15. This calculator will help with that. How to Use the ESPP Gain Tax Calculator Step 1 - Download a Copy To get the most out of this ESPP Gain and Tax Calculator youll want to download a copy of it.

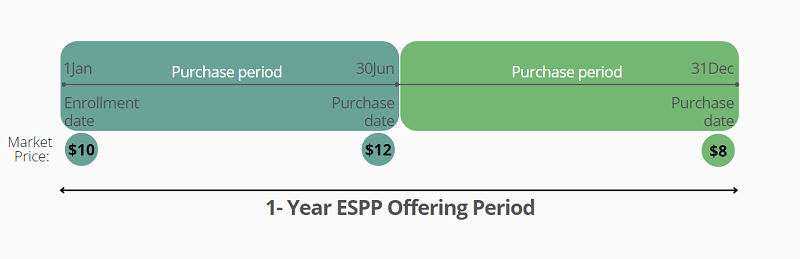

This calculator assumes that your purchase price is calculated picking the lower stock price between the purchase date and the first date of the subscription period. Ordinary Income Tax Owed 57600 Same as the above example Short Term Gains Tax Owed 24 x 750000 180000 Total Tax 237600 Just because you pay. Weve created this free calculator to help point you in the right direction.

The discount offered based on the offering date price or. Employee Stock Purchase Plan. First Day of Subscription Period Market Price on the First Date of Subscription Period.

When To Sell Espp Shares For Tax Benefits

The Ins And Outs Of Espp S Part 2 Fun With Taxes Financial Geekery

Espp Or Employee Stock Purchase Plan Eqvista

Accurate Cost Basis For Employee Stock Springwater Wealth Management

Is An Employee Stock Purchase Plan Espp Better Than A Retirement Account Early Retirement Now

2018 Employee Stock Purchase Plans Survey Deloitte Us

Employee Stock Purchase Plan Or Espp

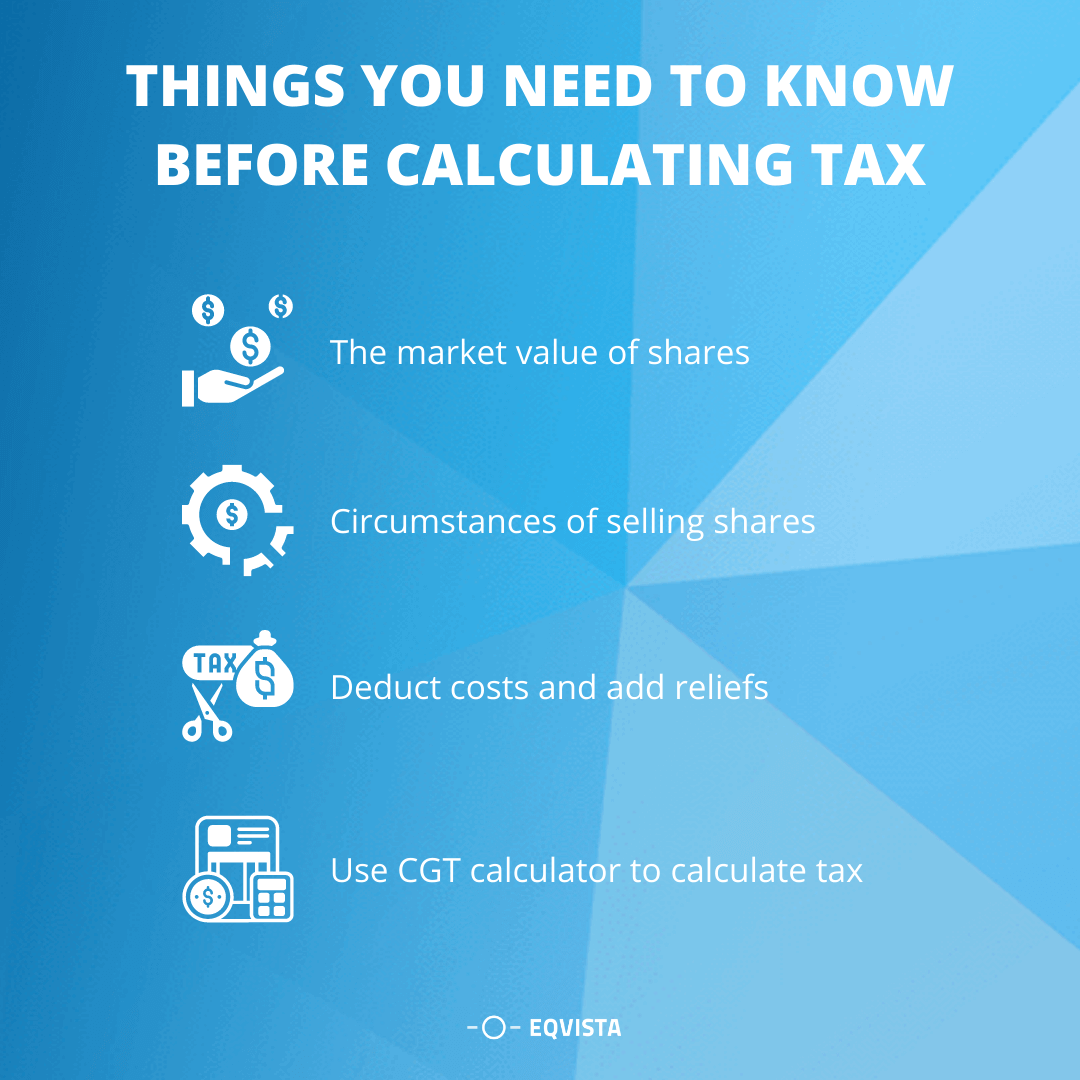

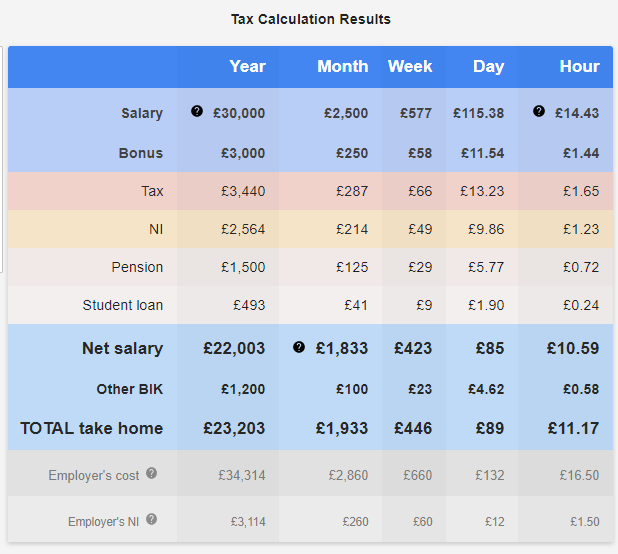

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Should I Participate In My Company S Employee Stock Purchase Plan Espp

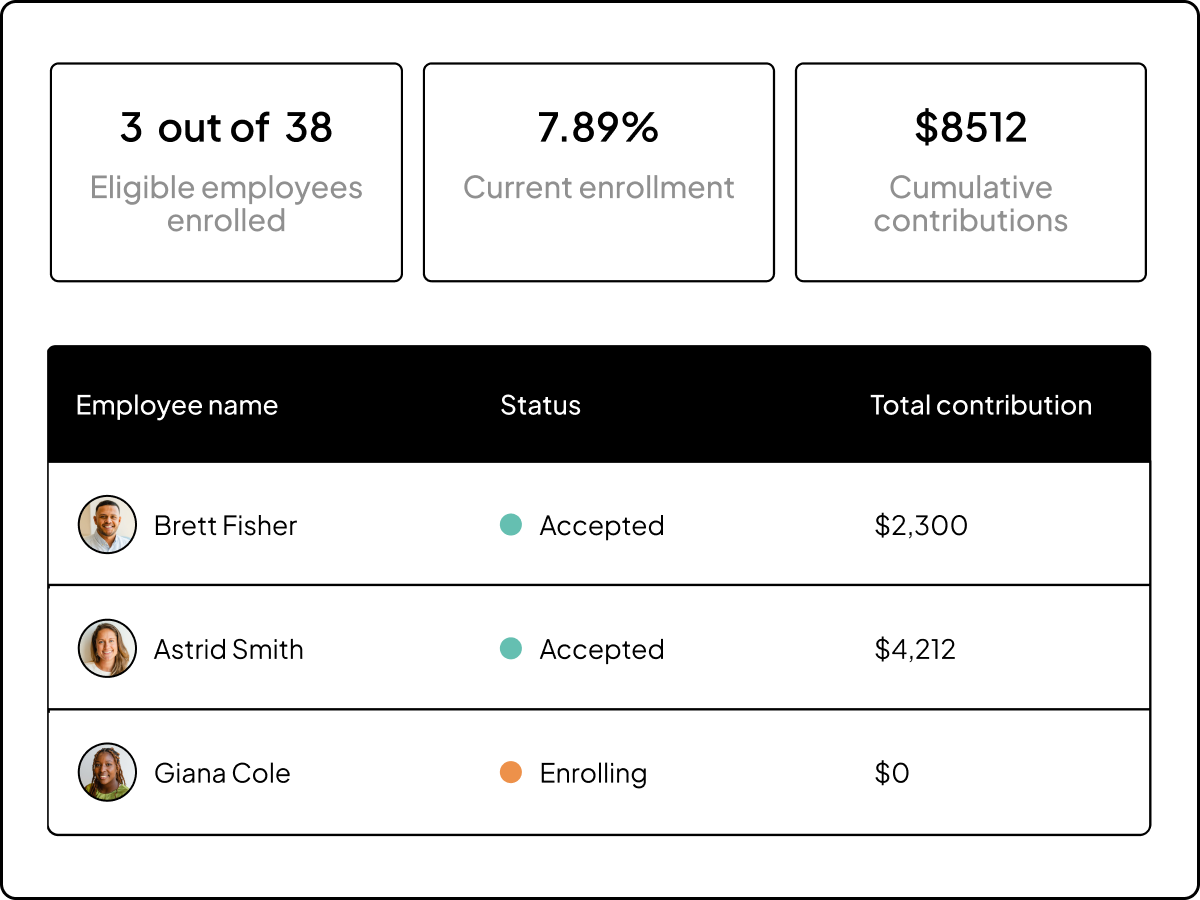

Employee Stock Purchase Plan Espp Software Carta

Employee Stock Purchase Plans Espps Understanding And Maximizing A Great Employer Benefit You May Be Missing Out On Sensible Financial Planning

Employee Stock Purchase Plan Espp The 5 Things You Need To Know

Planning For A Great Financial Future The Savvy Scot

Espp Calculator Employee Stock Purchase Plan Youtube

Rsus A Tech Employee S Guide To Restricted Stock Units

How To Calculate Capital Gain Tax On Shares In The Uk Eqvista

Always Participate In The Employee Share Purchase Plan Espp By Charlie Evans Medium